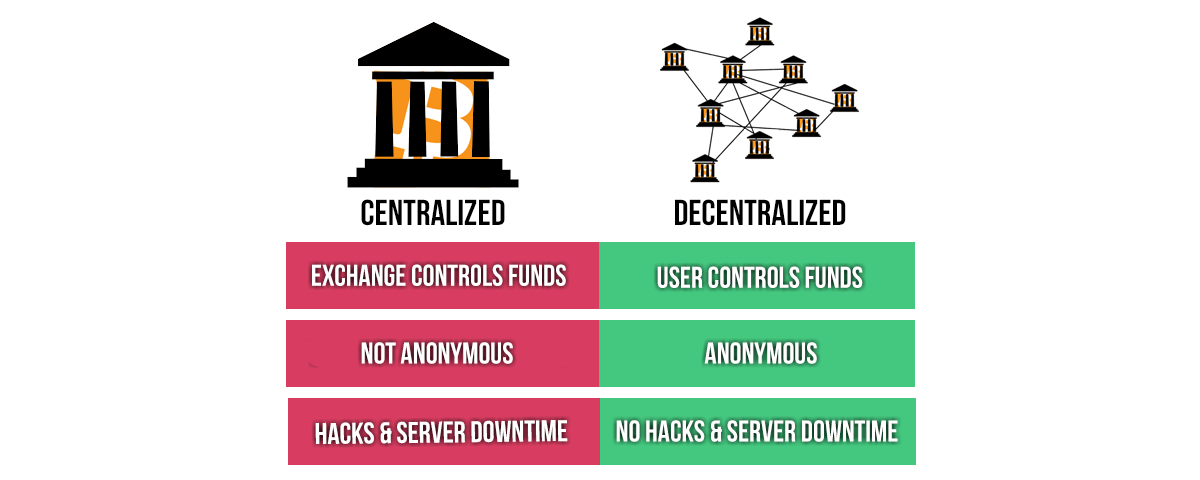

A decentralized cryptocurrency is one that does not have a central authority. Instead, it is managed by a group of people, avoiding the middleman and resulting in lower fees. In addition, decentralized platforms are more secure, which is another important benefit. Here are some of the advantages of decentralized cryptocurrency. Read on to learn more. – Decentralized exchanges reduce middleman fees and offer greater security. – Decentralized cryptocurrency exchanges reduce middleman fees and improve security.

Decentralized exchanges are a form of decentralized cryptocurrency

A decentralized exchange, or DEX, allows for direct peer-to-peer cryptocurrency transactions. This is a significant departure from centralized exchanges, where a third-party entity is responsible for securing user funds and transferring assets between two parties. As a result, DEXs are ideal for a number of reasons. These advantages include a lack of intermediaries, anonymity, and the elimination of “know your customer” regulations.

A decentralized exchange is not totally anonymous. It maintains the network of transactions by relying on servers to manage order books and other features. This means that investors cannot use an exchange to steal private keys. This method is similar to stock front-running, which involves buying a security based on insider information and then waiting for it to fall. However, the main benefit of decentralized exchanges is that they are safe and don’t have a single point of failure.

They reduce middleman fees

One of the most popular benefits of a decentralized cryptocurrency is that it cuts out the middleman. Instead of a central clearing house, a decentralized cryptocurrency exchange is a peer-to-peer venue. The transactions are based on smart contracts, atomic swaps, and decentralized ledgers, and all parties involved in the transaction are completely independent of each other. Furthermore, because a decentralized cryptocurrency does not rely on any central clearing house, consumers benefit from a number of advantages.

Another benefit of a decentralized cryptocurrency is its ability to lower fees. Unlike the traditional banking system, decentralized cryptocurrency transactions are not limited by geography, and they can be used for international transactions as well. With this type of system, it is possible to transfer money from one country to another without paying middleman fees or interest. In addition, because the entire process is based on peer-to-peer transactions, decentralized cryptocurrency is more efficient than traditional banking.

They prevent trading volume and price manipulation

The key to decentralized cryptocurrency is that its transactions are verified and recorded by the community of network users. The decentralized nature of the networks allows for the creation of elaborate contracts that allow users to exchange assets based on pre-specified conditions. Such contracts are essentially over-the-counter trades without intermediaries. A permissionless blockchain allows anyone to verify and record transactions, while a permissioned network requires pre-selected participants.

As cryptoassets continue to gain mainstream acceptance, market manipulation is a major concern. While governments continue to scrutinize the nascent crypto sector, they will be less successful once more regulations are in place. While centralized exchanges are more likely to discourage market manipulation, it is crucial for individual investors to do their due diligence and avoid common market manipulators. For example, if a particular coin has a low volume, it is easy to manipulate prices. Smaller exchanges are prone to large spikes and drops due to this. In addition, whales don’t need to purchase the asset to manipulate the price. They can simply send out cryptic tweets about its value and cause it to skyrocket or plummet.

They offer greater security

While centralized exchanges have some advantages over decentralized ones, they don’t offer the same security or privacy. Centralized exchanges rely on a central authority to manage the network of transactions, much like banks issue debit cards. However, decentralized exchanges rely on an interwoven system of users and do not require a centralized authority to manage transactions. This means that you have less risk of hacking and little reliance on third parties.

While security is certainly a huge benefit, decentralized cryptocurrency exchanges have some significant disadvantages as well. First, decentralized exchanges let you remain in control of your funds, avoiding the risk of exchange hacks and the loss of funds in the event of an attack. In addition, centralized exchanges pose significant internal security risks, requiring sophisticated systems to ensure complete security. Those vulnerabilities can cause total loss of funds if the systems are compromised. However, centralized exchanges mitigate this risk through API-based security policies. Decentralized exchanges eliminate the need for these policies because all operations must be signed by the owner’s secret key.

They are more susceptible to hacks

In 2017, Elon Musk complained on Twitter that crypto scammers are preying on the cryptocurrency community. In addition to stealing $600 million from a decentralized finance network, the Poly Network, an anonymous hacker also stole $150 million. However, the hacker eventually returned the stolen cryptocurrency to investors. And in December, Bitmart was hacked and its funds were stolen. Hackers used stolen private keys to open two “hot wallets” and steal the entire account. These hacks have fueled the cryptocurrency prices to soar in the last year.

A common mistake made by some new cryptocurrency developers is to use centralized exchanges as a savior against hackers. While centralized exchanges are easier to hack, their decentralized counterparts are far more vulnerable to hackers. Hackers must penetrate the defenses of the exchange company in order to access your private keys, financial data, and other potentially damaging data. Meanwhile, decentralized exchanges have much lower risks of hacks. Ethereum is aiming to switch over to a proof-of-stake consensus mechanism by July, while Bitcoin remains tied to the proof-of-work consensus mechanism, which requires enormous amounts of electricity and is more prone to hacks.

They are more popular than centralized exchanges

As the world of crypto evolves into a featured ecosystem, decentralized cryptocurrency exchanges are gaining popularity. Unlike centralized exchanges, which are based in one central office, these decentralized systems operate as peer-to-peer exchanges. In a decentralized exchange, there is no third-party escrow service to hold your assets, and all transactions are handled by smart contracts and atomic swaps. The key difference between a centralized and a decentralized exchange is their level of accountability.

Centralized cryptocurrency exchanges are more regulated than decentralized ones, which makes it easier for investors to invest in crypto. Centralized exchanges must follow strict rules established by local regulatory authorities, and require licenses for users to operate. A decentralized exchange does not require any licensing or regulatory authority, and can operate in banned regions. Nevertheless, a decentralized exchange offers a higher level of liquidity and better market makers than a centralized exchange.