You may have heard about the various ways to invest in cryptocurrency, but you may not know what they are. The first thing you need to know is that investing in cryptocurrency is not like investing in stocks. The price of a cryptocurrency can drop with a simple sneeze. This makes it very risky, but the benefits far outweigh the risks. Listed below are the top tips to avoid scams when investing in cryptocurrencies.

Passive vs. active investing

Passive vs. active investing in cryptocurrency is a big question for many investors. While passive investing is usually the safer choice, professional money managers can also make more money. Passive investing builds money over a period of time. Active investing, on the other hand, often loses money too quickly. This is because an active investor may not accurately gauge the value of a stock. Moreover, active fund managers are unable to beat the market’s major indices.

For active investors, investing is about timing and averages. Passive investors don’t fret over weekly fluctuations in the market, but instead aim to ride out the ups and downs of the market over the long term. Passive investors don’t make decisions on individual stocks, but rather focus on decades of trends. Passive investing, on the other hand, means buying low and holding on to investments. Passive investing entails no day-to-day work, while active investing focuses on the short-term.

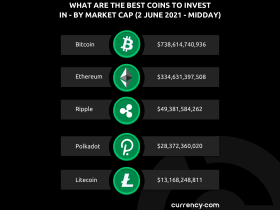

Bitcoin isn’t the best performing cryptocurrency

Although Bitcoin may be the best-performing cryptocurrency in the world, it is far from the best. That is due to two main reasons. First, digital currencies are not yet mainstream and lack real-world utility. In fact, Bitcoin and Dogecoin are only capable of processing 300,000 transactions per day, whereas Visa and MasterCard can process more than 700 million per day. Consequently, investors are not enticed to invest in either one.

Choosing a good cryptocurrency isn’t like picking a good stock

While there is an inherent risk in investing in cryptocurrencies, there is also the possibility of making a profit. The value of a cryptocurrency fluctuates, and timing the surge in the price is incredibly difficult. For instance, the price of Tesla could spike, and investors may rush to buy and sell in response to that. In a sense, it’s similar to the dot-com bubble when investors bought anything with “dot com” in its name. However, this is much riskier than in a traditional stock market, because you’re buying someone’s idea, not a currency‘s intrinsic value.

Scams related to cryptocurrency investing

There are numerous cryptocurrency investing scams on the Internet. Scammers create fake reviews and websites that look authentic. Be wary of any website that claims to be endorsed by celebrities, as they may have been paid for their endorsement. Be wary of websites promoting cryptocurrency investment schemes through celebrity endorsements. These websites can be scams themselves, so it’s important to be skeptical of any investment opportunity you come across. Listed below are a few ways to spot a scam in cryptocurrency investing:

Scams related to cryptocurrency investing also target investors through online dating websites. Scammers use attractive profiles to attract victims. They gradually gain trust, telling the victim about huge gains in the cryptocurrency market and convincing them to follow along. The scammers often take advantage of the fact that cryptocurrency is still new, meaning that there’s hardly any history to back them up. These scammers then make phony accounts to trick the investing public into buying their shares.