As the demand for digital currencies grows, so will the number of new payment cards for cryptocurrency. Here’s a quick look at how these cards work: what are their Rewards structure, how much they cost, and what kinds of funding they offer. The most popular types of these cards are the ones that give cashback rewards and tiers, which unlock higher limits for card holders. The number of such cards is expected to grow rapidly in the coming years.

Rewards structure

If you have a traditional credit card and would like to earn points or bonuses from your purchases, you may want to consider a crypto card. These cards are similar to traditional credit cards in terms of rewards structure, and can be used everywhere Visa and Mastercard are accepted. But, unlike traditional cards, they are not redeemable in a dangerous situation. You can trade your crypto rewards for cash or trade them for profits, depending on how well the currency performs when you sell it.

There are several entrants in the cryptocurrency credit card rewards race, and the BlockFi Credit Card is one of them. The BlockFi card comes with an annual fee of $200, but that fee was eliminated in late May, bringing it in line with other early competitors in the race to offer a crypto-specific credit card. The Gemini card and Upgrade card, for example, will both be free of annual fees once the waitlist period ends.

Security measures

There are several ways to increase the security of your cryptocurrency wallet. You can use two-step verification to ensure the safety of your account. To make sure your account is safe, you need to enable 2-step verification for all transactions made through your wallet. To set up 2-step verification, you should go to your account’s security settings and input a text message or your mobile number. It is also a good idea to lock down your mobile account. This will prevent unauthorized users from accessing your wallet.

Cost

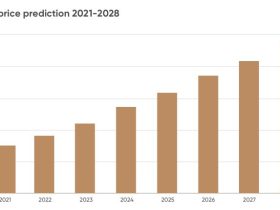

The global crypto card market is currently booming and is expected to reach USD Million/Billion by 2028. Several factors are contributing to the growth of this industry, including rising investments in R&D, the entry of new players, technological breakthroughs, and effective resource allocation. Furthermore, supportive government policies and favorable laws are expected to further boost the industry. This report offers an in-depth analysis of all key players in the crypto card market.

There are several different types of cards available. The most popular is the Coinbase card, which supports four cryptos. It is not available in the U.S. but is available in three other countries. Some crypto enthusiasts have also expressed concern about the Coinbase card’s solvency in 2020. Moreover, the Coinbase card has several benefits, including monthly reimbursement on subscription services such as Spotify, Amazon Prime, and Netflix. Another benefit of this card is that it lets users withdraw crypto for immediate use. Furthermore, the card supports Visa payments, which makes it convenient for crypto users.

Funding options

While crypto credit cards are not new, they have gained in popularity in recent months. While Bitcoin was originally hailed as a revolutionary payment method, most people now use them as speculative investments or stores of value. While public, decentralized blockchains have their limitations, crypto credit cards often offer a variety of funding options. In addition to using cryptocurrency, many crypto credit cards allow you to receive payments through bank wire or direct deposit.

While there are a number of risks involved in using cryptocurrency as a form of payment, crypto debit cards are still relatively new. In the U.S., a popular option is a personal loan. This type of loan is based on a person’s personal credit history and may have tax implications or restrictions. While it’s possible to apply for a personal loan with a crypto debit card, most of these loans are installment loans that require payments over a certain period of time. There are also fees associated with personal loans.