Tether cryptocurrency is a type of cryptocurrency which pairs the unrestricted nature of cryptocurrencies with the stable value of the US dollar. Stablecoins are increasingly popular as inflation hedges, and earn higher yields than savings accounts. However, they are not without their own risks, including platform and regulatory risk. The company was founded by Brock Pierce and co-founders Reeve Collins and Craig Sellars. Listed below are the most important facts about Tether.

Tether has been plagued by controversies about its USD reserves. The USD value of Tether has dropped as low as $0.88 at one point. This has caused many to question whether the currency‘s reserves are fully audited by an independent third party. The company has since made numerous updates to the underlying cryptocurrency, and the price has remained relatively steady. Tether crypto is also widely used in China’s informal financial sector and is crucial in facilitating capital flight out of the country.

Despite the controversy surrounding Tether, many in the crypto community are not worried about it. They rationalize that it is too big to fail and is easily replaced by another currency. In reality, Tether is very likely to face a showdown with government authorities and criminal investigators. The question is: will Tether survive? How do we know? Let’s take a closer look. There are several factors that could prove disastrous for the cryptocurrency.

One factor that might cause investors to question the stability of Tether is the fact that the issuer of the crypto does not have enough dollar reserves. This may not be a concern for some people, but in the case of Tether, the issuer broke down its reserves in May and revealed that only 2.9% of its holdings are in cash. The rest is in commercial paper, which is a type of short-term debt. Tether has been compared to traditional money-market funds and is the world’s top 10 holder of commercial paper. It also has more deposits in commercial paper than many U.S. banks.

While there are risks associated with investing in cryptocurrency, Tether is generally considered a relatively safe option for a long-term investment. Investors are quick to purchase it during downfalls, which is important in the case of currency fluctuations. Additionally, Tether tokens are exchangeable, meaning you can buy and sell cryptocurrency multiple times in a day. So, it’s possible to buy Tether without any risks, although Tether’s future success is dependent on market confidence. If the market loses confidence in the currency, it could lead to the insolvency of many cryptocurrency exchanges.

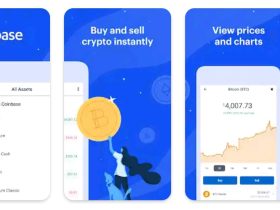

There are several exchanges that accept USDT as payment for USDT. Tether is also available on the popular Ethereum wallet (ERC20). The easiest way to buy Tether is to deposit money into your account or use a wire transfer. Some exchanges also support USDT but do not accept fiat currencies. While USDT has its advantages, it is not suitable for all investors. If you are worried about security, a trusted cryptocurrency exchange may be a better choice.

In addition to its security, Tether is tied to several fiat currencies. Each Tether token is worth one unit of fiat currency. It’s also part of other blockchains and protocols, such as Ethereum, Bitcoin Cash, EOS, and TRON. Additionally, Tether is a part of the Liquid Network and is part of the Liquid Network. It is a stablecoin because it reduces the risks that can be associated with extreme volatility.

Investors can buy Tether using most top cryptocurrency exchanges and apps. Tether’s price usually remains stable, at about $1. But investing in Tether is different from investing in traditional crypto currencies. Stablecoins are a subset of crypto. Their value is anchored to a stable asset, usually the U.S. dollar. That way, investors can use it as a means of exchange or as a mode of storage.

As the popularity of cryptocurrency continues to rise, it has faced numerous legal problems. In the United States, a federal investigation was conducted against Bitfinex and Tether following allegations of facilitating illegal transactions. Bitfinex and Tether have settled a $18.5 million settlement with New York Attorney General Letitia James. The New York Attorney General said that Tether’s claims about currency backing were “wildly misleading.” Throughout the trial, both companies voluntarily agreed to cease trading in New York and pay nearly $19 million in fines.

Tether has a stable value because it is tied to a high-value asset or commodity. The value of one Tether coin is always equal to one U.S. dollar. Moreover, Tether can be exchanged with other cryptocurrencies and sent to other cryptocurrency wallets. Traders should pay attention to Tether’s volatility because the value of Tether will go down if the value of fiat currencies decreases.