The Reserve Bank of India (RBI) has declared cryptocurrencies to be major threats to financial and macroeconomic stability in India. While the rupee is convertible, the cryptocurrency market has not yet been fully regulated. Regulators are worried about cryptocurrencies because anonymous transactions can’t be taxed or regulated, and can be used for money laundering and terrorism financing. To be sure, the Indian Government will need to study the cryptocurrency market closely before launching a new cryptocurrency exchange.

Taxation of cryptocurrency in india

The Indian government has announced that digital assets will be subject to 1% tax deductible at source, or TDS, once they reach a certain value. This tax is intended to discourage high-frequency trading, which would limit the growth of the cryptocurrency industry. In addition, the government wants to bring trading on foreign platforms under GST, which would make the entire process more efficient. But the issue of TDS still remains unclear, as there is no clear-cut rule on its application.

In general, it is possible to break down cryptocurrencies into their two components, consumption and pay. The two aspects would determine whether the cryptocurrency is subject to a different tax regime, or whether it is subject to different laws altogether. The two types of taxation are called direct and indirect taxes. Direct taxes are paid by individuals or entities and are assessed at a higher rate than indirect taxes, which are applied to goods. Depending on how much cryptocurrency is being used, the taxation of cryptocurrency may differ greatly.

Regulation of cryptocurrency in india

Regulators in India are mulling over regulations for cryptocurrencies. While the country has not enacted any laws yet, the Indian government is consulting with industry experts, ministers, and officials in a bid to determine the best regulatory approach. In the past, the government has argued against cryptocurrency as a currency, but it now seems that the country is taking a cautious approach to this growing industry. But if the government wants to control the growth of cryptos in India, this could be an issue.

Regulating cryptocurrency in India is important in many ways. The country’s economy is small, but its share in the global economy is just over three percent. Hence, it is important that the government implements regulations to prevent the misuse of cryptocurrency. The most effective way to regulate this industry is to listen to private and public sectors and reference global policies. A progressive country such as Japan has recently introduced new regulations that will ensure that all investors and traders comply with the same set of rules and regulations.

Impact of crypto on equity markets

The Indian government has yet to publish any figures on the number of people trading cryptocurrencies in the country. However, industry experts estimate that there may be as many as 20 million crypto investors in the country. The growth in cryptocurrency traders is being fueled by younger investors, mostly under 35 years of age and from small cities and towns. They are more interested in bitcoin than their parents were 20 years ago, when they parked their savings in gold and savings accounts.

This is because EMDE citizens are among the most frequent visitors of the major cryptocurrency exchange websites. These numbers may be double counted due to the use of different technologies and multiple exchanges quoting the same trading pairs. The recent sharp rise in crypto asset trading volumes may also be a contributing factor. Recent restrictions on crypto trading may also be the cause of this spike. Further, there is no single source that proves that the crypto industry is in any way disrupting the traditional financial system.

Impact of crypto on equity markets in india

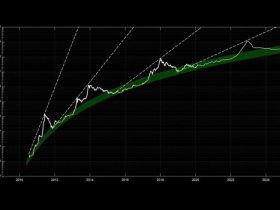

The tax on cryptocurrencies is likely to spur investors back to traditional assets, including equity. The current global market cap of cryptocurrencies is approximately $650 billion, but this number has decreased to $480 billion since the beginning of the week. It is unclear how this tax will affect the Indian market, but long-term investors are likely to ride it out. However, this tax will have a major impact on exchange volumes, order books, and arbitrage trading.

While the government hasn’t released estimates on the number of investors in crypto in India, industry experts say that the number is approaching 20 million. Many of these investors are younger, from towns and smaller cities. Their interest in crypto is much higher than that of their parents 20 years ago, when they were more likely to invest in gold or savings accounts. For this reason, cryptocurrency exchanges in India have struggled to hire experienced staff.