If you are considering making a cryptocurrency investment, there are a few things you should keep in mind. While it is a risky way to invest in securities, crypto coins act as money. Tokens are digital collectibles, which allow developers to create a cryptocurrency without building a blockchain. In addition to cryptocurrencies, NFTs are also collectibles, and they allow developers to create a cryptocurrency without building a blockchain.

Tokens allow developers to create a cryptocurrency without building a blockchain

Compared to coins, tokens are much easier to create. They also tend to launch less impressive projects than coins. That said, tokens are not necessarily bad investments; some have very interesting use cases. Unlike coins, tokens allow developers to create a cryptocurrency without building a blockchain. This makes the process much simpler, faster, and cheaper for developers. Below are some reasons to use tokens instead of coins.

The most popular way to create a cryptocurrency without building a full blockchain is to use a developer-created token. These tokens are not native to any blockchain, but are created by many developers. To make a token, developers must first find the right source code, as well as check to ensure it is legal. The Ethereum blockchain has been specifically built to host cryptocurrencies by multiple developers.

Crypto coins act as money

What is cryptocurrency? In its simplest form, cryptocurrencies are digital tokens that act as a form of money. Because they have no intrinsic value, their worth is determined by the demand for them. This is unlike national currencies, which get part of their value from being legitimated as legal tender. The most popular cryptocurrencies are Bitcoin and Ether. If you’re new to the concept of cryptocurrency, here are some basic details.

The biggest and most famous cryptocurrency is Bitcoin, which was launched in 2009. There are many other popular cryptocurrencies, including Ethereum, XRP, and Bitcoin Cash. Each one serves a different purpose, and some are designed for cash-like transactions, while others are intended for more private transactions. They’re all digital and the owner holds them in a digital wallet. This wallet can be an online account or an offline wallet stored on a hardware device.

NFTs are digital collectibles

These collectibles are virtual assets that are not exchangeable for other virtual currencies. They act as collector’s items and cannot be copied. They have a high value in the market, and people buy them as a way to prove ownership of virtual assets. However, be aware of scams and fraudulent activities. Some sellers will claim to sell an NFT of a work they don’t own. Others may create copies of the NFT for a higher price. Therefore, it is best to buy them from trusted sources only.

The NFT market has grown exponentially since 2008, with artists and brands such as Kings of Leon and Paris Hilton getting involved. Fans can unlock exclusive perks by purchasing NFTs of their favorite musicians and artists. One NFT can even grant a fan exclusive access to a video clip of Banksy burning his artwork. Another NFT can give collectors a VIP concert experience. The value of NFTs is estimated to reach $100 million by 2020 and $41 billion by 2021.

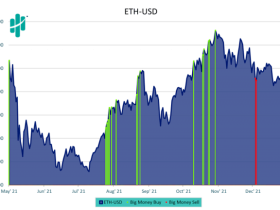

Investing in cryptocurrencies is risky

Investing in cryptocurrencies is risky, but you can earn money from them if you’re willing to bear some risks. While you should seek financial advice before investing, diversifying your portfolio is an excellent way to minimize your losses. However, if you’re not comfortable with the risk, you should stay away from cryptocurrencies. You should also consider the long-term growth potential of these digital assets.

Unlike traditional stocks, cryptocurrencies are subject to market risks. You can lose all your money, or even your entire investment. To minimize these risks, make sure that you invest only in regulated exchanges and rely on their experienced professionals. It’s not uncommon for a reputable exchange to include a similar disclaimer in its legal documents. A reliable exchange should have an incorporated physical address and a dedicated support team.

Tokens are a tradable investment

There are many benefits of buying cryptocurrency coins. The most obvious is that they are tradable. Unlike stocks, however, they have no physical value and are completely unregulated. There are no governments to protect you from fraud or unauthorized trades. In addition, you have no recourse if hackers steal your wallet. Stocks, on the other hand, are traded on accredited exchanges around the world. These markets have strong regulations and are designed to handle large volumes of trading daily. This means that you can buy stocks with confidence, knowing you have the same protections as a stock investor.

As with any investment, there are risks involved. Although the potential for profits is great, cryptocurrency is also highly volatile and can plummet on the smallest rumor. Nonetheless, sophisticated investors can take advantage of the volatility and execute trades quickly. Because of the lack of legal tender currency and consumer protections, investors should treat crypto as a speculative investment. Fortunately, there are many advantages to owning cryptocurrency.

Investing in cryptocurrencies with credit cards is complex

One of the most common mistakes made by novice investors is investing in cryptocurrencies with a credit card. This method is not only risky, but can cause a person to become deeply in debt. Not only can you incur interest, fees, and high credit utilization rates, but you could also lose the entire value of your investment. Therefore, investing in cryptocurrencies with a credit card is complex, and it should be avoided at all costs.

Using a credit card to purchase cryptocurrency is convenient, but it is not a wise investment. The price of cryptocurrency is extremely volatile and highly risky, so taking on debt to buy it is not recommended. Additionally, platforms that accept credit card payments usually charge additional fees to cover their costs. Plus, credit card companies often treat cryptocurrency purchases as cash advances and charge a higher rate of interest immediately. To add insult to injury, these fees may even be more than you paid for the cryptocurrency.