Bitcoin is a cryptocurrency, a form of digital currency, that is different from fiat currency. Blockchains are public, immutable, distributed, and decentralized. The list of its uses is virtually endless, but the primary one is to secure digital goods. Among its other uses, cryptocurrency is useful in the world of business. Here are some of them. But what is the point of cryptocurrency? Its main benefit is that it is a convenient, decentralized, and accessible medium of exchange.

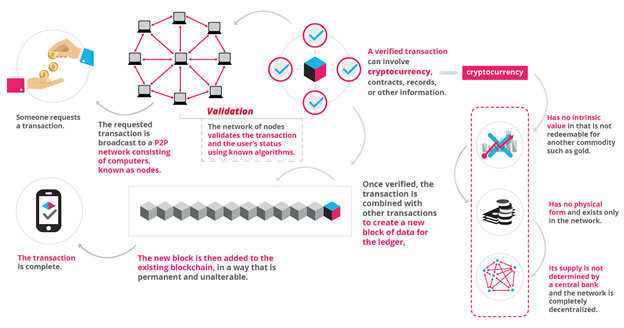

Blockchain

You might have heard of Blockchain and its benefits. It has greatly facilitated the establishment of business relations, executed safe transactions, and retained transaction records. It has allowed for a variety of credit options and new sorts of marketing. Blockchain has significantly reduced scams and thefts. As a result, it is poised to replace the likes of PayPal and other content delivery networks. In the near future, Bitcoin will likely be worth more than $384K.

Blockchain technology works by using a network of linked databases, known as blockchains. Each block contains certain information that can’t be altered. Blockchain can be used to transfer money, track property, and create contracts. The network is based on decentralized computing and decentralization, making it accessible to anyone, anywhere. The main advantage of blockchain technology is that it provides a high degree of security and privacy. Its decentralized nature makes it much more secure and scalable than any other type of currency.

Decentralization

There are many benefits of decentralization, and cryptocurrency is no different. The most obvious is that it increases competition in the financial world. In a centralized financial system, new companies or institutions have a difficult time getting started. There are no third-party handlers or regulators, and the risk of exploitation is much higher. But a decentralized digital currency is like the Wild West – there are many opportunities for people to benefit from its decentralized infrastructure.

One of the primary reasons cryptocurrency has been so popular is that it is decentralized. While most currencies are backed by a central bank, such as the U.S. dollar, cryptocurrencies are maintained by users and are not backed by a central authority. This makes them appealing to investors who want to avoid the centralized authorities in traditional financial markets. However, despite the decentralized nature of cryptocurrencies, the current financial system makes it nearly impossible to avoid centralized authority.

Transparency

In a world dominated by decentralised and opaque businesses, transparency is essential. In order to create a level playing field for all players, cryptocurrency developers must clearly detail expenses. Without such information, it can be hard for investors to determine the true value of a given coin. The whitepaper for a new cryptocurrency must clearly spell out all expenses, making it easy for investors to determine the profitability of the asset. Additionally, crypto assets, expenses, and capital should be transparently reported in order to simplify the assessment of profitability. Without transparency, crypto assets, expenses, and capital are not reported to the market, which creates a poor precedent for the industry. Furthermore, serious investors prefer coins that are not too concentrated and do not use excessive leverage.

While many global technology giants have already taken steps to protect cryptocurrency users, more needs to be done. The crypto industry must demonstrate its legitimacy to investors and educate a broader audience. Until now, the industry has been slow to acknowledge its value. But now, with a new wave of regulations coming online, it is important to keep in mind that there’s no one way to determine whether a cryptocurrency is worth investing in.

Accessibility

When sketching the protocol for a new user, accessibility should be a priority. In other words, the user should be able to perform a transaction within a few clicks, without needing to install an external plug-in or manually set the parameters of the transaction. A holistic accessibility framework will consider the user experience of wallets and other tools used by new users. This way, the protocol will be accessible to all users, regardless of their level of skill.

Accessibility can be measured by the number of languages supported by a blockchain. Bitcoin and Ethereum, for example, have a high number of node operators. This speaks to the security and reliability of the blockchain. As a result, accessibility is an important consideration when comparing different blockchain projects. As a starting point, look at the user guidance process. Typically, the first-time user interaction consists of setting up an account, injecting capital into the account, and making their first transaction online. These processes should be as easy as possible, with minimal technical knowledge required.

Lack of consumer protection

There are numerous concerns about the lack of consumer protection in cryptocurrency, from fraud to the risks of losing one’s money. Various states are attempting to regulate the cryptocurrency space, including Maine, which recently enacted new laws to protect consumers. Furthermore, the Bureau of Consumer Protection recently confirmed that it is capable of regulating digital currency transmission. In the meantime, local authorities must be aware of potential scams in the cryptospace.

Regulators can address these concerns by enacting new rules that would require prominent disclosures of material risks, including the risks of losing money. In addition, traditional regulations would require prominent disclosures of historical returns, with the caveat that past performance is no guarantee of future returns. However, if regulators cannot control the advertising and promotion of recent cryptocurrency windfalls, consumers may be harmed. Fortunately, CFPB is working on new rules that would allow consumers to control how their personal information is shared and used. These regulations will affect both banks and fintech companies, and could have implications for crypto firms.