Bitcoin is a popular digital currency that allows peer-to-peer transactions on the internet. The decentralized nature of Bitcoin has allowed it to soar in value during its early years, but it has since come down from its peaks. If you’re considering investing in this currency, here are some of the most important things you should know about it. Also, remember that its price is highly volatile, so investing now could make you a millionaire overnight!

Bitcoin is a decentralized, peer-to-peer digital currency

A decentralized, peer-to-peer electronic exchange, Bitcoin is an unregulated currency that enables people to send and receive money directly between themselves without a third party. This unique feature of Bitcoin allowed the currency to be created so that people could not rely on financial institutions. Bitcoin users use a distributed ledger called the bitcoin blockchain to keep track of transactions, using the proof-of-work system.

The blockchain is a shared database that contains data about all of the world’s transactions. The data in the blockchain is encrypted to prevent hackers from accessing the data. When a transaction is confirmed by a validator on the network, a new block is created and the miner who verified the data receives Bitcoin in return. However, the price of Bitcoin is constantly fluctuating, making it difficult to predict its future value.

It allows secure and seamless peer-to-peer transactions on the internet

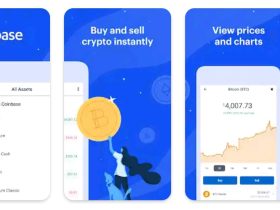

Bitcoin, or BTC, is a digital currency that enables secure and seamless peer-to-peer web transactions. This currency is not controlled by a central authority, but by a network of users. In addition to allowing users to make secure and seamless peer-to-peer transactions, bitcoin can also be sold for profit. Its technology is based on blockchain, which supports over fifty different protocols.

Bitcoin is a native technology of the internet, enabling anonymous online transfers. This means that there is no middleman, allowing money to travel the global web more quickly. And because the network is completely decentralized, anyone with a computer and an internet connection can participate. This opens up new possibilities for the financial sector, as bitcoin is the first truly open payment network. As a result, it doesn’t depend on any private company to make a transaction.

Its price has fallen off of its highs

The Bitcoin cryptocurrency has dropped significantly from its record highs in late 2017 to just under $33,000 on Sunday. Although there were no immediate causes for the plunge, it did echo the broader stock market decline of the week, when investors shifted from riskier assets to more stable options. Although it’s still early to draw conclusions about the cryptocurrency market, it might be worth looking into. In this article, we’ll take a closer look at what’s going on with the BTC cryptocurrency.

Bitcoin is currently approaching the lowest point since July 2021. It has dropped below a rising trend line that was drawn three months ago, indicating a new market trend. Bitcoin has dropped 49.5% from its all-time high. The downward trend is expected to last for the next several days. However, a test of the $30,000 level is possible. While it is still early to predict the price of the cryptocurrency, analysts have pointed out some factors that may contribute to its drop.

Its volatility

When it comes to bitcoin, the volatility is one of the biggest concerns in the market. As the price of the cryptocurrency rises and falls dramatically, it can be hard to predict when to get in or out. Several factors can cause the price to fall, from the price of the underlying Bitcoin currency to a rising or falling market. While Bitcoin is one of the most volatile currencies on the market, it’s still much less volatile than other cryptoassets.

The first step to investing is understanding your level of risk tolerance. Everyone has varying levels of risk tolerance, and it can affect the type of investments you choose to make. If you are a 25-year-old growth investor, for example, you will naturally take higher risks than a 60-year-old retiree. Remember that risk is proportional to returns, so it is important to understand that your risk tolerance can affect the level of volatility in the market.