In this article, we’ll look at KYC, or Know Your Customer, and why this service is critical to anti-money-laundering regulations. You’ll also learn about how easy it is to trade against the international border. Kyc crypto is an increasingly important part of AML regulations, as this type of identification is crucial in the fight against money laundering. This article also touches on how kyc crypto helps in this regard.

kyc crypto is a form of identity verification

KYC is a method for verifying the identity of clients. It is a requirement for all financial organizations, regardless of size, to have this process. In the crypto industry, KYC is especially important because of the lack of transparency, which leaves criminals open to disguising their activities. Fortunately, there are some solutions to this problem, such as implementing a digital wallet. Here are some of them.

KYC is a standard requirement for centralized crypto exchanges. Some anonymous buyers may still find other options, such as peer-to-peer marketplaces and Bitcoin ATMs, but these are less convenient and often require the buyer to pay more for the transaction. However, buyers should be prepared to go through the KYC process regardless of the exchange. KYC is a quick and easy process, and once complete, the process will allow them to buy crypto without issue.

It is a crucial component of antimoney laundering (AML) regulations

KYC is an essential part of antimoney laundering (AML) regulations. Currently, governments require financial institutions to collect data about their customers, including their addresses, names, and social security numbers. Crypto exchanges may go a step further to run a background check on customers, too. By complying with KYC regulations, companies can make sure they’re doing business with legitimate people and avoid possible criminal prosecution.

Currently, 69% of cryptocurrency exchanges do not have complete KYC procedures. Developing a thorough AML program is crucial, and KYC procedures help ensure that financial institutions are compliant with AML regulations. Anti-money laundering (AML) regulations are necessary to prevent the laundering of money from the United States. AML regulations are also vital for exchanges and custodian services.

It is reliable

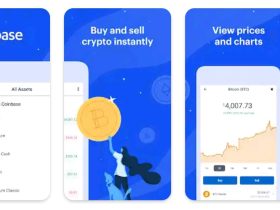

If you’re looking for a reliable and trustworthy cryptocurrency exchange, KYC is not necessary. Coinbase, a leading exchange without KYC requirements, offers over 400 cryptos, altcoins, and tokens. Its platform is based in India, and it has completed over 1 million transactions. Coinbase is a popular choice among traders, with over 6 million registered users. To maintain the highest levels of security, it uses a secure system that blocks out fraud and provides the highest level of customer support.

In addition to KYC, a reliable cryptocurrency exchange will be able to provide you with a reliable trading platform without requiring any KYC documents. If you don’t feel comfortable providing these documents, BaseFEX is one of the most reliable crypto exchanges without KYC. The platform features massive spreads and transparent conditions. You can use it to trade altcoins, forex, indices, CFD crypto, and more. You can also deposit and withdraw BTC without verification, making it a highly competitive platform for trading the traditional markets.

It is secure

The KYC (Know Your Customer) process is one of the key components of anti-money laundering regulations, and is becoming increasingly important for the growing crypto industry. If cryptocurrency exchanges did not require users to provide KYC, they could not guarantee that their clients’ funds are secure. This is directly at odds with the crypto philosophy. By requiring users to provide identification, KYC ensures that exchanges do not become a target for criminals.

The cornerstone of crypto KYC is streamlined identity verification. Companies must ensure that sensitive personal information is handled safely to meet privacy regulations and bolster consumer confidence. Cryptocurrency has strict rules surrounding immutable transactions and anonymous exchanges, making KYC a must-have for secure exchanges. KYC helps vendors maintain their reputations while maintaining consumer confidence and privacy. KYC is the best way to avoid such risks.

It helps protect clients’ assets

KYC is a process of identifying and verifying customers, to comply with counter-terrorism financing and anti-money laundering laws. Many organisations are adopting electronic KYC measures to prevent unqualified people from trading on crypto exchanges. These systems can be very helpful for cryptocurrency exchanges. Among the benefits of KYC is the reduction of money laundering and terrorist financing risks. In addition to these advantages, KYC can help protect client assets from unauthorized transactions.

While cryptocurrency trading is a legitimate market, it is not without risks. Moreover, if not done properly, cryptocurrency exchanges can be held accountable for illegal activity. In fact, it is essential to use KYC procedures. Not only do they protect clients’ assets, they can also reduce the risk of fraudulent activities. KYC is a good investment strategy for cryptocurrency exchanges. By ensuring that the funds used in crypto transactions are legitimate, they will be more profitable.